After our feature about fast fashion, we heard from a different — and vocal — segment of the market: plus-sized women.

“I’d love to see a piece diving into why such a large percentage of the buying public are ignored by retailers and fashion brands,” one person wrote.

Plus sizes, generally referred to as sizes 14-34, aren’t as readily available as straight sizes (0-12). And yet, the average American woman wears a size 16-18 with a 37.5-inch waist. A full 67% of adult American women wear a size 14 or larger. Yet plus-sized apparel makes up just a tiny sliver of the clothing on the market.

Why is this? It appears that retailers are simply ignoring the buying power of this segment of the apparel buying market. Here's what they're missing.

Buying power

Many brands have a very narrow view of who their customer is. There appears to be a belief that plus-sized customers don’t spend as much as their straight-sized sisters. But that's simply not true. In fact, the only reason this appears to be true is because plus sized customers have far less clothing options to choose from, giving them to fewer opportunities to spend their money.

A full 67% of adult American women wear a size 14 or larger.

Plus-sized shoppers represent $20 billion worth of buying power. In fact, the buying power of the plus-sized market is growing at a faster pace than that of the rest of the apparel industry. Annual sales of women’s clothing sized 14 and higher rose 17% from 2013 to 2016. This is a significant jump in an era when consumers spend more on electronics and experiences (over possessions, including clothing). By comparison, overall sales of apparel grew by 7% in the same time period. Yet, retailers are slow to get on board.

Retailers Not Embracing Plus Sizes

Retailers would do well to tap into the buying power of this segment if only they would risk embracing the category. Plus-sized lines at department stores and other mainstream stores tend to come and go. New plus sized lines are debuted with press and promises and are then reduced or eliminated like any other line regardless of demographics. That turns plus sized shoppers off. After all, when a woman can’t count on finding her size at a particular store, the store is removed from her list of options. This is incredibly short-sighted on the part of the retailer. After all, those plus sized customers could be spending their money on shoes, jewelry, handbags, and other accessories while they're shopping for clothes.

This fickleness has driven plus sized shoppers online. E-commerce sites simply offer plus sized women more consistency and variety. For example, online sales of plus size retailer Ashley Stewart brings in a third of the company’s revenue. That’s up from absolute zero just seven years ago.

Out of the 25 largest clothing retailers by revenue, all but four offer a minimal line of plus-size options. In other words, if you were to ask the CEO of one of these stores about their lack of options for women size 14 and up, they’d likely say that they do offer options for that segment of the market. The thing is, those options are much more limited than the ones offered in sizes 0-12.

At J.C. Penney, 16% of the dresses on the website are plus size. At Nordstrom.com, only 8.5% of the dresses are plus sized. When it comes to a retailer’s brick and mortar store, plus sizes can be even harder to find. Physical stores stock fewer items and have less variety.

The disconnect between what customers want and what stores offer is plagued by an old stigma in the fashion industry. For decades, brands have shied away from plus sizes in the belief that they are bad for the brand. On the retailer side, stores think of plus size as an add-on to their businesses along with petite-sized and maternity lines.

Stores often hide their plus-size offerings in corners of their stores, making the shopping experience uncomfortable and even embarrassing. Meanwhile, designs are often concealing rather than fashionable and colorful. Still, other sotres ignore the category all together such as parent company of The Limited L Brands did with Eloquii. The much-loved plus size alternative to The Limited and Express was shut down after two years. Consumers were upset and made it known. Since then, Eloquii was bought during a liquidation sale and relaunched.

Prohibitive Costs

Retailers cite the exponential cost of making a plus-size line. It isn’t as simple as taking a size 6 model and proportionately sizing up. When it comes to plus size women the variations in body type and shape are greater than that of a, say, woman who is a size 6 and one who is a size 10. This means designers have to make special patterns for larger sizes. And, of course, plus size clothing uses more fabric, more pieces to fit a larger woman’s curves, and that leads to a greater cost of both material and labor. Meanwhile, factories in China and Vietnam are not set up to make clothing in bigger sizes. Changing out the factory to do so is costly and time consuming.

One of the most interesting (and sad) aspects about the lack of availability of plus size options is how it directly reflects the attitudes towards and general ambivalence of size and weight in the American concept of beauty. But, times are changing and retailers who don’t embrace what are the sizes of the majority of American women are going to be left behind by this very powerful buying segment.

The Availability Of Plus Size Stores Vs. Regular Sized Stores

There is a flourishing plus-size retail market, however. Stores such as Lane Bryant, Ashley Stewart, Torrid, Cato’s, Macy’s, J.C. Penney, Maurice’s, Roman’s Eloquii, Woman Within, Talbot’s Plus Size, and Old Navy all cater to this growing segment.

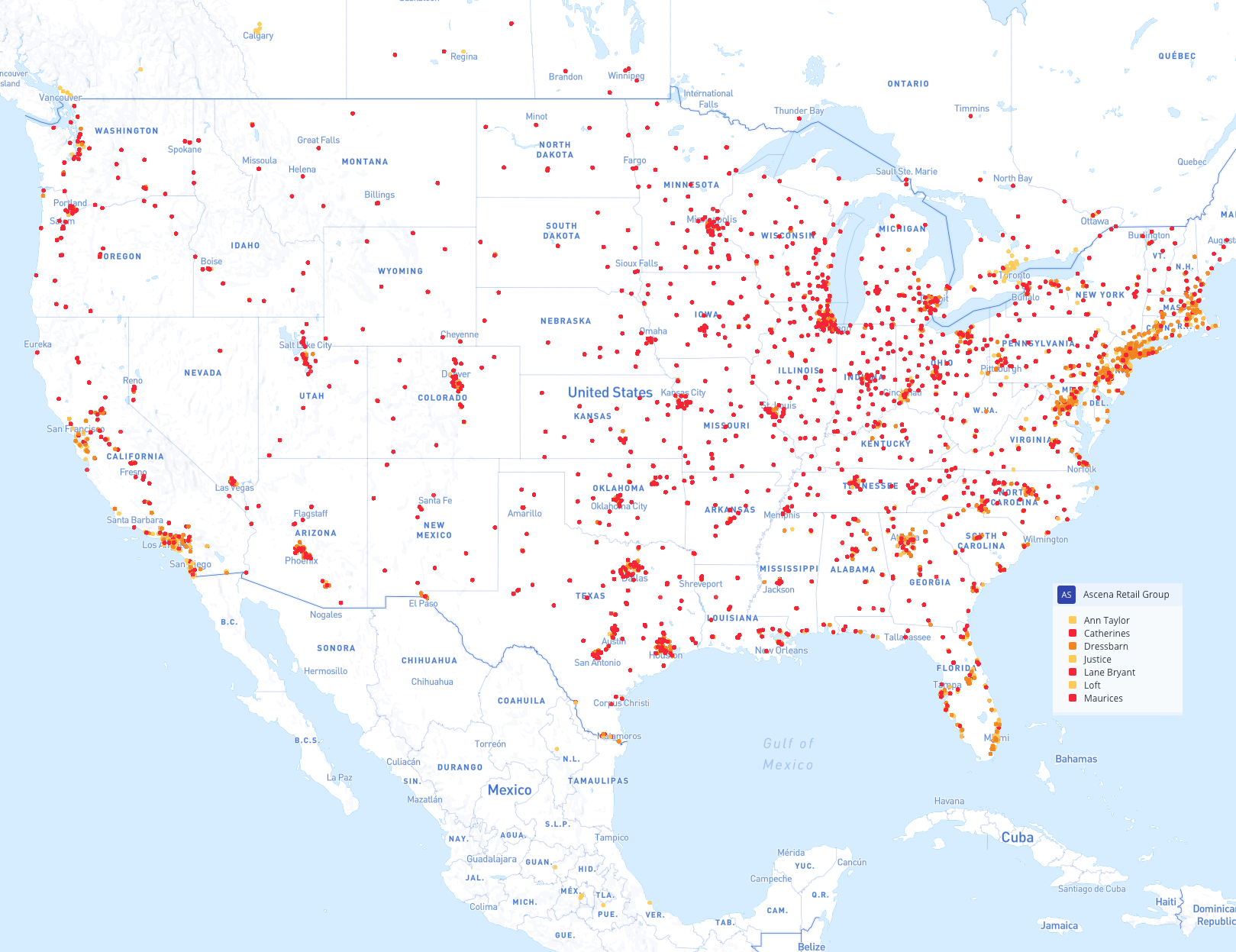

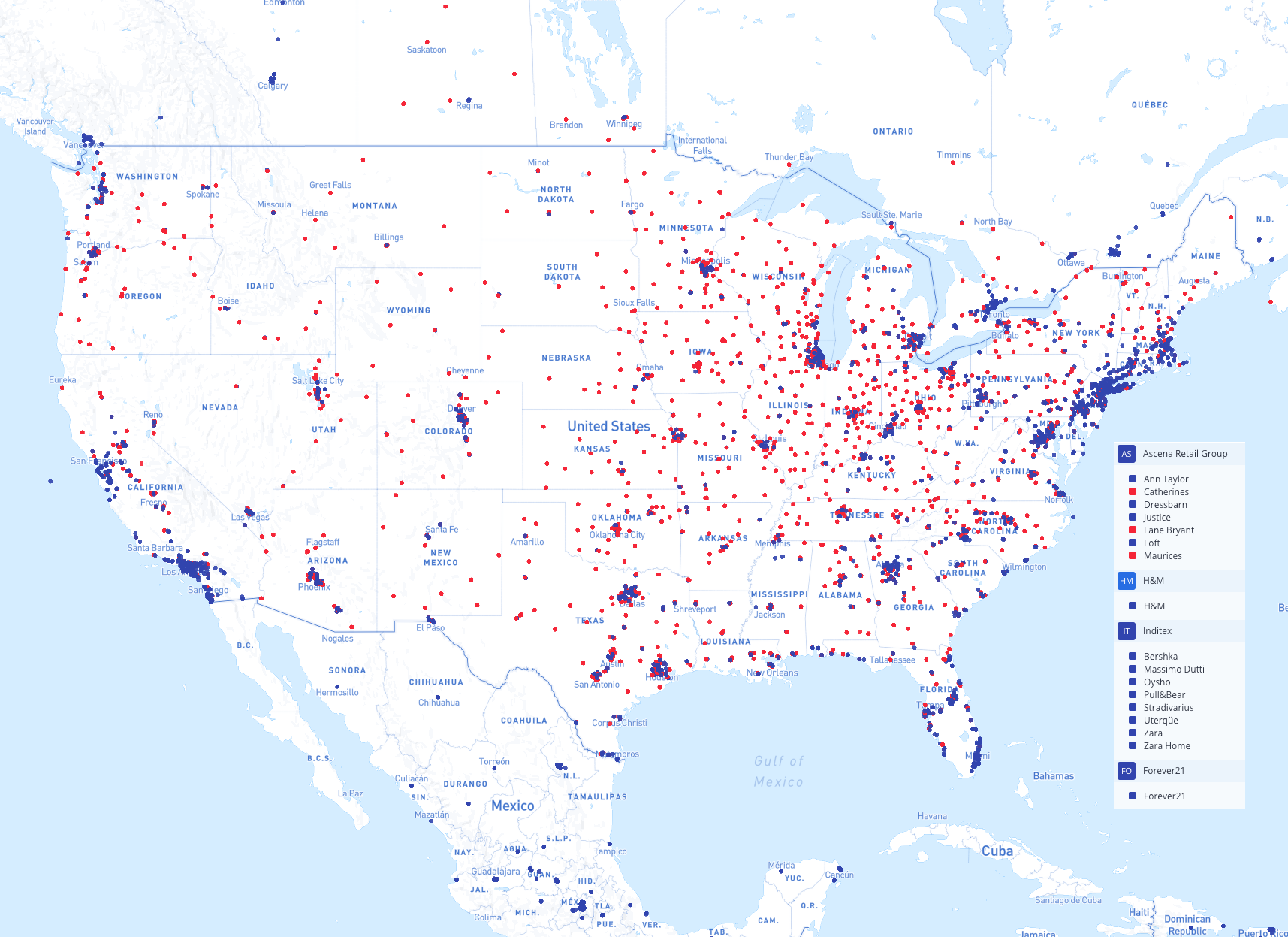

The Ascena Retail Group ($ASNA) is the parent company of Maurice’s and Lane Bryant as well as Ann Taylor or Loft Stores. Looking at two plus-sized brands vs. two straight sized brands under the same company reveals a commitment to their plus size brands. There are 2,047 Maurice’s and 1,570 Lane Bryant stores versus just 202 Ann Taylor and 528 Loft stores.

However, when you compare the number of fast-fashion stores to dedicated plus sized retailers, we see quite a different story. H&M has 4,590 stores in 63 countries. Zara has 2,200 stores in 88 countries. Forever 21 has 561 stores in the Americas, the UK, Asia, and the Middle East. And, of course, women who wear a size 0-10 can walk into nearly any store and find options that fit. Those who wear a size 12 are left out of some brands, or left with options more limited than 0-10, but not quite as limited as sizes 14 and larger.

Why Startups Aren't Addressing The Issue

Startups, by their very nature, are disruptors. They innovate. They cater towards a segment or industry that is long overdue for change and updating. So why aren’t there a bunch of startups trying to conquer the $20 billion annually plus sized apparel industry?

In a climate where retailers are already anxious for shoppers embrace the notion of “experiences over possessions,” it's likely considered too risky to make clothes for plus size women despite the fact that this segment is begging for more options. Retailers and brands want to do business with as many customers as possible, yet so few have any interest in dressing plus-size women.

Fashion startups are in a position to change this. They are building businesses and product lineups and supply chains and fulfillment centers from scratch. Many of them are focused on improving sizing and fit. They can choose any customer base they want to serve from the inception of their startup. What better time to innovate for the plus-size marketplace? Unfortunately, just like the traditional retailers they are aiming to disrupt, most of them have shown little to no interest in creating apparel for plus size customers.

There is a $20 billion annual segment of ignored customers out there waiting for someone to listen to what they want and need: fashionable, colorful, on trend clothing (as well as traditional and business clothing) that fits their bodies. It isn’t too much to ask.

Data

Subscribers can click here to access the mapping data used for this story.