Number of the Week: $240 million (explanation below)

More Trouble with Buy Now, Pay Later

February 7th’s FIN installment “Buy Now, Pay…Never?” was barely out the digital door when more data emerged suggesting that BNPL may be harming consumers. That issue focused on research from the UK showing that 44% of consumers who used BNPL plans for their Christmas shopping are wondering if they can make their payments without further borrowing.

Then on Monday, Credit Karma and Qualtrics released a survey of American BNPL users. It showed that a little more than 40% of Americans have used BNPL services (a higher percentage than I would have guessed). Of those, 38 percent say that they have fallen behind on their payments at least once; and of those who have fallen behind, three-quarters say it’s hurt their credit score.

That’s not a small group. Conservatively, say there are 200 million Americans over the age of 18; 40% of that is 80 million people. That means 30 million Americans have missed a BNPL payment, and 22.5 million of those have had their credit scores dinged for it. Considering that BNPL as we know it did not even exist a few years ago, it’s clear that a sizable portion of American consumer debt has been transferred to the BNPL sector in a very short period of time.

This isn’t meant as alarmist. Many people can take a short-term hit to their credit score without suffering any serious consequences. Moreover, depending on the terms of your deal, you’re probably better off missing a BNPL payment than you are falling behind to credit card companies (or, even worse, payday lenders; a pernicious force in American financial life which has declined in recent years but may be seeing a pandemic-fueled revival).

Nonetheless, millennials and Generation Z are the heaviest users of BNPL, yet also the most likely to have the smallest savings, plus student debt; especially in a recession, piling more debt onto this group could be very harmful. If the trend continues, it seems likely that Biden’s Consumer Finance Protection Bureau will want to examine the BNPL sector.

Will any of this matter to the big BNPL players, such as Affirm and Klarna? Affirm’s stock is so volatile that it can drop 10% in a day (as it did on Friday) and no one seems to panic; it’s hard to say what investors are reacting to. In late 2020, Klarna was adding a million new US users to its platform every month, and the company’s catchy Super Bowl ad is likely to continue the momentum.

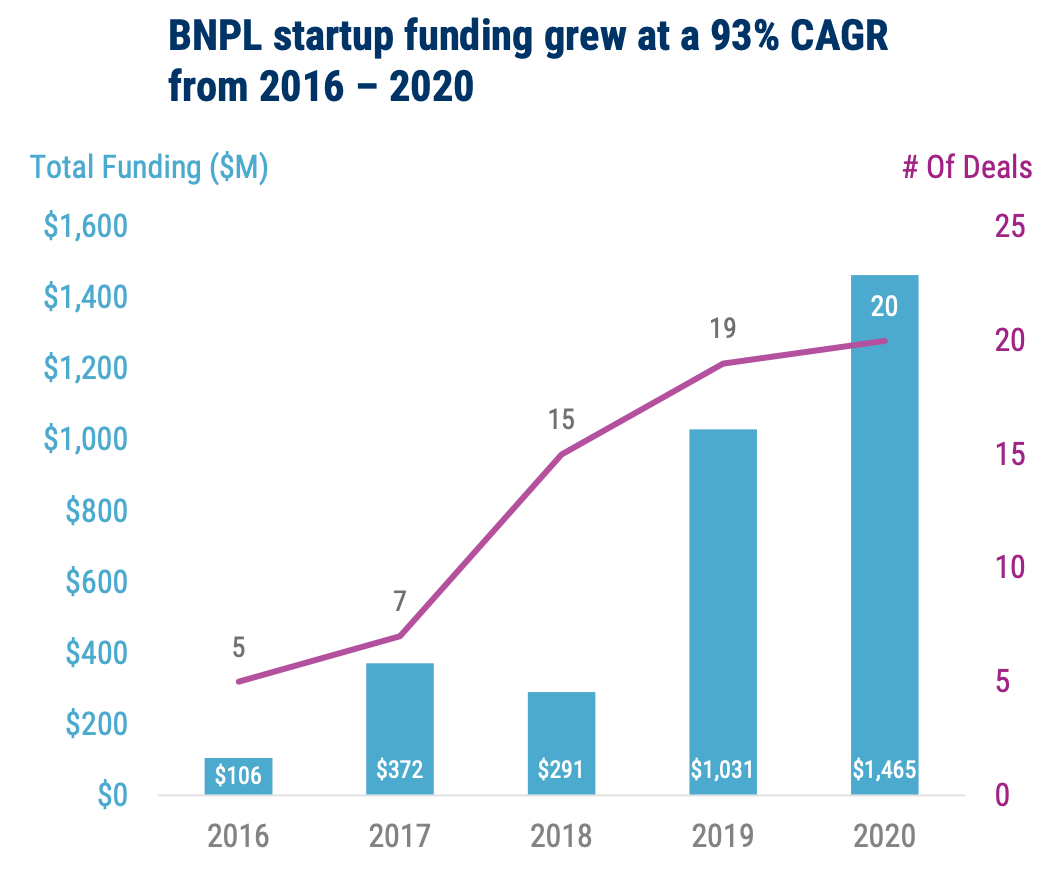

If anything, the BNPL sector is still in early innings. Venture capital moguls have been pouring money into BNPL startups for the last few years, as this eye-popping chart from CB Insights makes clear:

The pressure on these BNPL startups to grow quickly will be intense; it won’t be surprising if by next year’s Super Bowl, half the country is using BNPL. (And that doesn’t even account for extension of BNPL into business-to-business transactions.)

Is there another, better way to get credit to younger consumers? Kristy Kim, founder and CEO of TomoCredit, says there is. TomoCredit this week announced a $7 million seed round, featuring investors such as Barclays and Arlan Hamilton of Backstage Capital. Kim told FIN that while companies like Affirm are selling convenience, TomoCredit is trying to solve a deeper problem: lack of access to credit. Tens of millions of young Americans have plenty of cash, she argues, but no credit history and thus find it hard to obtain traditional credit cards; Kim herself, born in South Korea, struggled to get credit when she moved to the US.

The idea here is a credit card that acts like a debit card. Instead of making money by charging fees to customers, TomoCredit charges merchants. TomoCredit customizes credit limits based on a customer’s bank account and other abilities to pay, keeping its customers on a tight leash while allowing them to build up a credit history. “The major problem that people have is that [credit card and BNPL companies] encourage overspending, and people find themselves in trouble,” Kim said. “For Tomo, it's literally impossible for you to do so.” If TomoCredit customers miss a payment, their cards are cut off until they pay—no late fees, no interest charges. Kim told FIN that TomoCredit is so good at identifying creditworthy consumers that its default rate is below 0.1%; if true, that is an industry-beating accomplishment, and TomoCredit will have no difficulty finding investors for its Series A.

It’s too soon to know if TomoCredit’s model will offer a viable alternative to BNPL, or even hold up. Innovation in the sector is desirable, but it will be most effective if it’s intelligently regulated.

You Read It First in FIN!

From FIN’s 2021 Predictions issue, December 20, 2020:

Digital currencies will increase their acceptance. Many prominent fintech companies gave Bitcoin a stamp of approval this year, from Square’s investment of $50 million in Bitcoin to PayPal allowing its users to buy and sell Bitcoin. In 2021 we will see an extension of this mainstream embrace: Look for at least one major US or European bank to announce some kind of system where they either enable Bitcoin purchases or agree to hold digital assets for their clients.

The world's biggest custodian, BNY Mellon, has formed a new enterprise-wide digital asset division to help clients invest in crypto markets. The cross-functional, cross-business team…is currently developing a client-facing prototype that is designed to be the industry's first multi-asset digital custody and administration platform for traditional and digital assets.

Serving the Most Underbanked

Sometimes you read a story that’s so striking it makes you wonder why you’ve not read ten more like it before. This week the Web site Tearsheet published an article pointing out that Native/First Nation populations are the most underbanked in North America. Citing the most recent Federal Deposit Insurance Corporation (FDIC) banking survey, the story notes that 16.3 percent of the American Indian and Alaska Native communities are underbanked, higher than any community surveyed by the FDIC. Reporter Rimal Farrukh noted that “the average distance from the center of a reservation to the nearest bank is 12.2 miles with an average distance of 6.9 miles to the nearest ATM.”

FIN asked Farrukh, who is based in Pakistan, what inspired her to write the story. “The limited media coverage related to banking Indigenous communities is bewildering,” she replied. “Despite…a lot of academic research on the subject, Indigenous people are still often overlooked when it comes to news on financial inclusion.” Farrukh is not without hope; after all, discrepancies like this are theoretical opportunities for fintech. Her story looks at institutions (such as Native American Bank and OneFeather) trying to reach this population in the US and Canada.

FINvestments

🦈Number of the Week: You may not think of Western Union as a fintech company, and maybe it isn’t. Still, in the fourth quarter of 2020, its digital revenues came in at $240 million, up 36% year-over-year, with digital customer-to-customer transactions up 83%. What’s more, the company’s leaders insist that its growing, app-based digital business isn’t stealing from its brick-and-mortar locations, but rather from rival banks and money transfer firms.

🦈There were so many fintech SPAC deals announced or completed this week that we’d almost need a separate newsletter to keep track. One of the largest was MoneyLion, a digital banking platform now valued at $2.9 billion.

🦈A Canadian cryptocurrency lender called Ledn this week announced that it had raised a second seed round of $2.7 million. Ledn specializes in making loans in Latin America and plans to extend to other emerging markets; some of its micro-loans are as low as $500.

This column originally ran in James Ledbetter's FIN. To subscribe to his weekly newsletter, click here.